Unraveling the capitalist cosmology: Ray Brassier on the ontology of finance

In Huis Oostpool in Arnhem, Beirut-based philosopher Ray Brassier gave a presentation named ‘Pricing Time: Remarks on the Ontology of Finance’, moderated by DAI core tutor Bassam El Baroni. The lecture, co-organized by HEAD CCC Research in Geneva, was set up as a restructuring of Suhail Malik’s 2014 paper ‘The Ontology of Finance: Price, Power, and the Arkhéderivative,’ presenting a novel contribution to political economy through the derivate market and capitalist power.

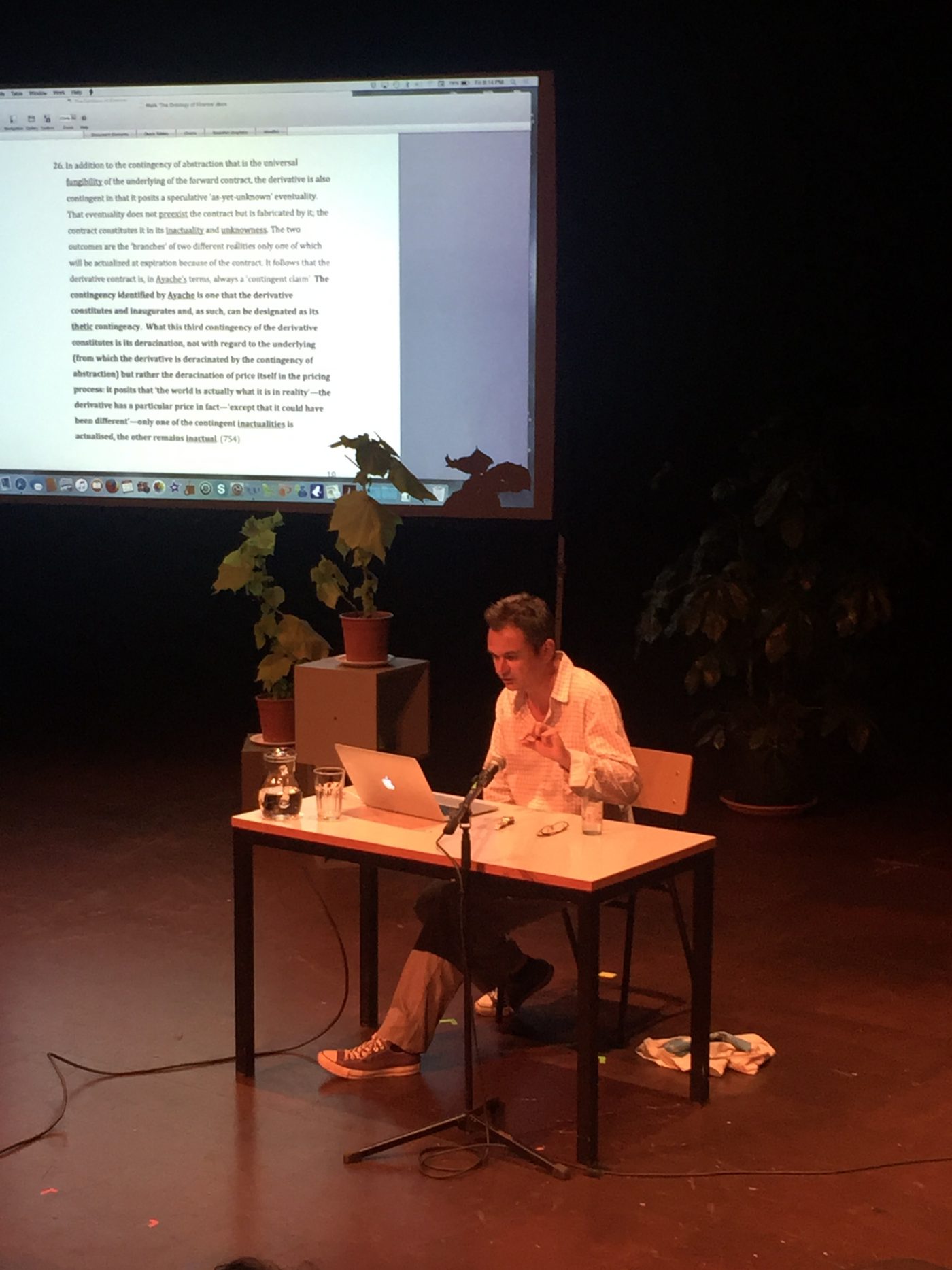

Brassier is one of the exciting and inspiring representatives of contemporary European philosophy. He is an associate professor at the American University of Beirut and has translated the works of other important contemporary philosophers such as Alain Badiou and Quentin Meillassoux. Brassier is a sharp and critical thinker with a twist of sophisticated humor in his work, and not shy to critique his contemporaries. In an interview with Polish magazine Kronos for example he commented on the new philosophical movement speculative realism, saying that it is a ‘blogger movement’, not believing that ‘the internet is an appropriate medium for serious philosophical debate; nor [that] it is acceptable to try to concoct a philosophical movement online by using blogs to exploit the misguided enthusiasm of impressionable graduate students.’ Brassier’s book Nihil Unbound: Remarks on Subtractive Ontology and Thinking Capitalism from 2007 deals with the problematic of time and what to do with it, a negotiation of truth, and therefore intersected with this lecture on Malik’s paper. Brassier’s talk discussed the key moves in Malik’s argument and showed these on a word-document projected on a large screen behind him.

The lecture was a special event, because Brassier barely writes about art or art practices. In fact, after the lecture he confessed that he had never responded to art works before and does not really know what art is anymore, especially when it comes to the period after modernism. His nihilistic stance came to the fore when he said that art does not need theory like speculative realism and new materials. According to Brassier, artists should not use theory to justify their work; it should stand on its own. In the case of new materialism for example, a theory that rethinks material also rethinks its use and therefore art, so it should not be dismissed so quickly. His confession was telling for the lecture, since the subject bore little resonance to art practices and was rather a heavy theoretical elaboration that needed full attention and preferably a pre-reading of Malik’s 177-page paper (unless you are a financial whiz kid of course).

What did Brassier’s restructuring of Malik’s paper bring us? The main claim that can be made is that the practice of pricing transforms social institutions and its relationship to the future only because it effectuates a radical ontological indetermination, which is the unfolding of time. Brassier claimed that this is an emancipation because politics is not indebted to the power of projection. It means that you can engage in radical transformation by enduring a model of predication. Malik states that indetermination is everywhere in reality and that we have to find ways of coping with it. Brassier infers from this that any attempt to predict or control will lead to political authoritarianism, bringing Malik’s paper more down to earth, to the political reality. He provides an interesting advice saying that the best we can do is inscribe indeterminacy and thus take risks in relation to the future. Brassier claims that we know enough about determination to identify ‘lapses of determination’, the relation between the determinable and indeterminable is thus dialectical, not transcendental as Malik claims. The advice that Brassier gave, taking risks in relation to the future, might be the only concrete and applicable clue from the lecture. Even though the inference comes from financial risk, Brassier transposed it to the realm of our lives, making it valuable for the graduating DAI students.

Even though the inference comes from financial risk, Brassier transposed it to the realm of our lives, making it valuable for the graduating DAI students.

Moreover, the notion of contingency does a lot of work in Malik’s paper and is decisive, since contingency is radically different from chance, which is calculable while contingency is incalculable. The notion of contingency in Malik’s paper is necessary because is it decoupled from actuality. It also makes a claim about time as pure potentiality. The claim that the reason markets have such a radical status is because there is an inscription of absolute contingency. During the lecture, El Baroni tried to make a connection with artistic practices by observing that one could think of market making as a form of writing, as a performative practice, which is according to El Baroni, where the links with artistic creation can emerge. However, according to Brassier, there is a problem with that observation. If you call inscribing ontological contingency creation, you might end up with a theological notion of creation, namely creation ex nihilo. Equating the power of God to create something from nothing with artistic practices, employing this absolute contingency, takes you back to the very romantic and theological notion of the artist as God.

However, may Brassier disregard El Baroni’s link that quickly? On a philosophical level, maybe. But what El Baroni did was transforming the highly technical and financial lecture into something graspable and fruitful for the audience, something Brassier ignored to do either due to a lack of time or lack of knowledge about art theory as such.

This account is seemingly anti-humanistic, since volatility is endogenous and there are no extraneous factors influencing pricing; whatever the trader does is inscribed in absolute contingency. The trader is then reduced to a vehicle of a cosmic force, isolated from other social parties, with the power to make and unmake social institutions. Brassier opts for a switch in perspective if you refuse to segregate the doer from the deed. The transcendental indetermination can be seen as a kind of contingent human practice. Trading becomes a game of human beings and because of particular circumstances that game has the power to make and unmake social systems and is therefore political.

It is Malik’s use of ontologicalization and transcendentalization of contingency that Brassier finds problematic. A social medium has to be re-introduced into Malik’s paper in order to anchor the practice of pricing, otherwise pricing becomes a free loading cosmic game. Pricing in Malik’s account has the ability to overthrow all other games through which people pursue their interests. Brassier argues that it is a mistake to ontologize games this way, precisely because games are played by humans: we have the capacity to play games. This is an interesting notion that Brassier hints at; who can participate and how? We do not know how to play the game, we just know that we can play it. Malik’s account seems anti-humanist but is in fact extremely humanist, because it claims that only human practice can inscribe absolute indeterminacy. This is exactly what a machine cannot.

So how did this restructuring alter perspectives on art? How can it provide new insights for artistic practices?

So how did this restructuring alter perspectives on art? How can it provide new insights for artistic practices? A clear answer to these questions is hard to give. Brassier did hint at some interesting points that have ramifications for art and its relation to the financial market, in which art is used as alternative investments to diversify risk for example. But is Brassier’s lecture the perfect fit for graduating art students? I have some doubt about that. Through his critical stance towards new philosophical movements he may stimulate the students’ minds, and of course the content that was presented is on itself incredibly interesting and shows a completely different way of looking at derivatives, pricing and capital. But it was displaced regarding the audience of art students. A refreshing theoretical breeze is always welcome though, since the philosophical debates are getting rusty and repetitive. Maybe it would have been better if the lecture revolved around Brassier’s own book Nihil Unbound, which offers more points of departure for artists than ‘The Ontology of Finance’. Brassier is an incredibly intriguing philosopher with new philosophical insights. He did convey the consoling thought that we humans are playing a game, leaving space for art to explore the potentialities and virtualities that pricing poses, because luckily we are capitalist cosmonauts.

‘Pricing Time: Remarks on the Ontology of Finance’, Huis Oostpool, 23.06.2017.

Corine van Emmerik

is art historian